Division of Interest File

Each Unit has many Owners.

Each Unit must have the Owners Percentage assigned to it in the Division of Interest File.

See Oil & Gas Business for Dummies

TIME SAVER

You can also use the Quick Copy Tool, to quickly copy DOI Owners from One Unit to Another Unit.

Select Master - Division of Interest

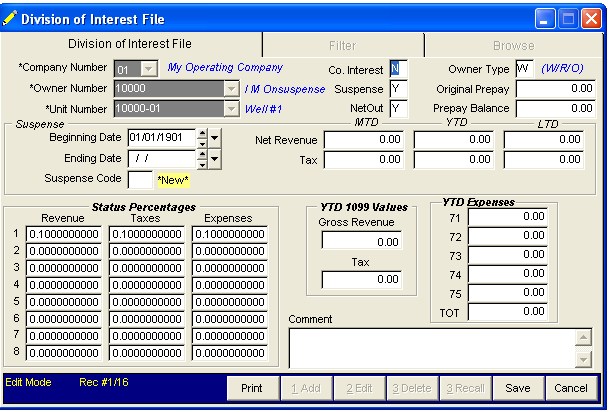

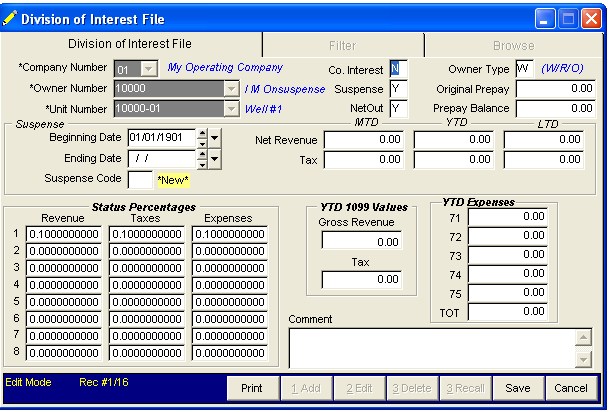

The Division of Interest file stores each owner’s percentage of ownership in a particular unit. The year to date 1099 values for gross revenue and taxes along with the year to date expenses is also stored in the DOI file. The DOI file contains year to date cumulative Government Form 1099 values for expense, revenue and tax for each owner on a unit. This file is updated after each update of Operating Statements. If you entered DOI user defined descriptions in Setup Options program under File on your tool bar, the descriptions will print on each DOI report. To save input time when entering owners for the same well, use the carry add feature. Be sure to change any percents for a different owner. You have a feature located on the Filter tab that will allow you to print, or not to print, for Inactive Wells on your DOI report. You must check your Unit/Well file to insure that the ‘Close Unit’ field is marked before you use the ‘Print Inactive Wells’ field in the DOI. If you do want this ‘Inactive Well’ to print, you must insure that on the Filter tab ‘Print Inactive Wells’ is marked. If you do not, the DOI looks in the Unit/Well file for any wells marked ‘Inactive’ and does not print on the report.

You can also use the Quick Copy Tool, to quickly copy DOI Owners from One Unit to Another Unit.

OWNERS THAT HAVE BOTH WORKING INTEREST AND A ROYALTY INTEREST MUST HAVE TWO DIFFERENT OWNER NUMBERS SET UP IN THE OWNER FILE. The IRS requires separation of the revenue on Government Form 1099 forms at the end of the year.

Note: In order to display all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

NOTES ON FIELDS

OWNER NUMBER: Owner number assigned in the Owner/Customer file.

UNIT NUMBER: Well number assigned in Unit/Well file. An owner that has an interest of revenue, tax and or expense must be assigned for each unit in the Division of Interest file to calculate their share for Operating Statements.

COMPANY INTEREST: Used to determine if this owner has any company's interest in this unit. Normally owner numbers from 99990 to 99999 are used for company interest. If this field is marked ‘Y’, the revenue, tax and expense interest for each transaction status is used to calculate the P & L report for the company interest. Values for the Company Interest P & L report are stored in the Unit Chart of Accounts and are updated when you close the period.

SUSPENSE: Specifies whether or not the owner is on suspense for this unit. If marked ‘Y’, revenue checks, from Operating Statements, are held in suspense and not issued to the owner until his suspense is changed to ‘N’. An owner’s suspense status may be changed in the DOI file or in the JIB program on your tool bar under Tools for Statements. See How to Use Suspense for more info.

NET OUT: Specifies net out condition for this owner on this unit, provided the netout field in the Owner/Customer file ="E" (each unit is to be netted on an individual basis). If the netout field in the Owner/Customer file is="E" and the netout field here in the DOI file is marked ‘Y’, current expenses and prior invoices for this unit are deducted from revenue for this owner on this unit. If the netout field in the owner file is anything other than "E", this DOI netout field is not recognized and has no effect. See How to Use NetOut's for more info.

OWNER TYPE (W/R/O): Working interest, royalty or override owner.

ORIGINAL PRE-PAYMENT: This is the original pre-payment amount advanced for any expenses to your company. Enter prepay balances in the JIB program on your tool bar under Tools for Statements, Add Prepayment. This program will automatically update the DOI file (Original Prepay and Prepayment Balance fields), Bank file and the Transactions file. You may also refer to the ‘Add Prepayments’ under the JIB section of the Manual. See How to use PrePayments for more info.

PRE-PAYMENT BALANCE: If an owner prepaid any expenses, this is the balance remaining of the prepayments. This field is updated, when you run the update for Operating Statements. Any amount used in the Operating Statement to offset his expenses will be subtracted from this field and the proper debits and credits will be made automatically to the Transaction file. You should print the Prepayment report from the JIB program, on your tool bar, under Other Reports and compare the company total to the Trial Balance for the prepayment general ledger number. These totals should always agree. You should not adjust this figure manually.

SUSPENSE BEGIN: When an owner is placed on suspense, you must specify a beginning suspense date. The Non Released Suspense report can not be run without a beginning suspense date, since this date is used to gather the records from the Year to Date Transaction file. See How to Use Suspense for more info.

SUSPENSE ENDING: When an owner is released from suspense the current months first transaction date less 1 day is plugged into this field. The date is used to print the Released Suspense report.

SUSPENSE CODE: You can use a 2 digit code to identify the reason for an owner being on Suspense. You can make up your own list of codes.

NET REVENUE IN SUSPENSE (MTD, YTD AND LTD): This is the gross amount of revenue minus (federal backup withhold amount and or state tax withhold amount if any) and the gross taxes, for the month, year to date and life to date. These fields are updated during the Operating Statement update and are triggered from the field suspense in this same DOI file. When an owner is taken off suspense, these fields are cleared and the life to date net revenue in suspense plus the life to date tax in suspense is placed in the gross revenue released year to date. You should print the Non Released Suspense report from the JIB program on your tool bar under Other Reports and compare it to Trial Balance general ledger number 21010. These totals should always agree. If an owner has federal or state tax withheld, is in suspense or has minimum check amount, the federal or state tax withheld amount will be updated to gross revenue released year to date when Operating Statements are updated. Net suspense or minimum check amount is minus federal or state tax withheld. Federal and state tax amounts will be stored in the Owner/Customer file for 1099 printing. See How to Use Suspense for more info.

TAX IN SUSPENSE (MTD, YTD AND LTD): These fields reflect an owner’s tax in suspense for the month, year to date and life to date. Just like the suspense revenue fields, these fields are updated during the update for Operating Statements, and are triggered from the suspense field. When an owner is taken off of suspense, these fields are cleared and the life to date amount is added to the tax released year to date field. See How to Use Suspense for more info.

PERCENT OF OWNERSHIP FOR EACH STATUS: These values are used to calculate the owner's share of revenue, taxes and expenses for the Owner’s Share by Unit report and when printing Operating Statements. The percentage that will be used is determined by the status field used when entering a transaction for general ledger numbers 3xxxx, 5xxxx, 71xxx-75xxx with a unit number. For example, if you use a status of 3 for a revenue, tax or expense transaction, then percentage level 3 (rev3, tax3, and exp3) is used for all owners under that status in the DOI file for that unit.

GROSS REVENUE RELEASED YTD: Reflects the gross amount of year to date revenue released for this owner on this unit. This field is updated each time you run the Operating Statement update.

TAX RELEASED YTD: Reflects the amount of year to date taxes - production taxes, severance taxes, (not federal or state tax withheld) released to the owner. This field is updated each time you run the Operating Statement update.

71 EXP YTD, 72 EXP YTD, 73 EXP YTD, 74 EXP YTD and 75 EXP YTD: General ledger numbers 71000 through and including 75999 are considered as billable expenses to owners. Therefore, all debits and credits made to these general ledger numbers are used to determine expenses for the owners during printing of the Operating Statements. They are categorical expense fields and are updated each time you run the Operating Statement update.

TOTAL EXPENSES YTD: Year to date total of all expenses for general ledger numbers 71000 to 75999 expense fields. Each time update for Operating Statements executed these fields will be updated with cumulative information for the year to date expenses.

COMMENT: Any comment for this owner on this unit.

Related Topcis

Oil & Gas Business for Dummies ~ How to Use Suspense ~ How to Use Net Out ~ How to use PrePayments ~ How to Add PrePayments ~ How to Refund a PrePayment ~ Government Forms

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.